Settlement discounts

A settlement discount is where a business offers another business a discount when an invoice is paid early. This is usually a percentage discount if an invoice is paid within a specified number of days, for example, a 5% discount for invoices paid within 15 days.

Settlement discounts can be recorded for both sales and purchase transactions - the discounts that you allow your customers and the discounts that your suppliers give you.

Settlement discounts and VAT

UK

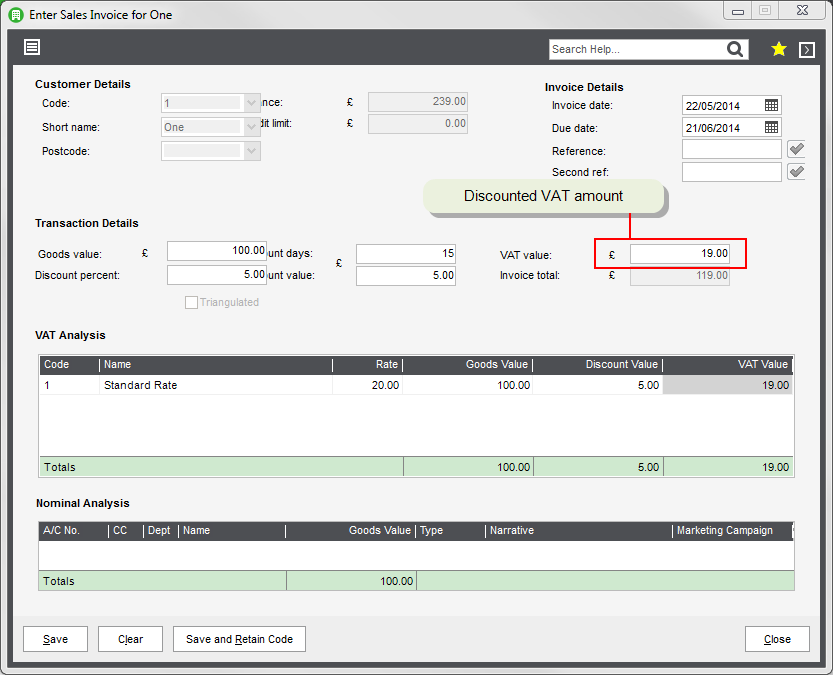

In the UK, if the invoice is paid within the settlement discount period, then VAT is only charged on the discounted amount (Goods value minus Discount value).

When an invoice that contains settlement discount is paid within the discount period, the VAT is only charged on the discounted invoice amount. VAT must be calculated and shown on the invoice at the full rate. If the customer pays within the settlement discount period, the VAT is discounted and a VAT adjustment must be processed.

Businesses must:

- Notify their customers of the VAT discount available and the amounts the customer is due to pay. This can be done in one of two ways:

- Issue an invoice detailing the full net and VAT payable. If the invoice is paid within the discount period, issue a VAT only credit note to account for the VAT discount.

- Issue an invoice document which states the amount of discount (net and VAT) that can be claimed if the invoice is paid early, as well as the full amount (net and VAT) due after the settlement discount period. If the invoice is paid within the discount period, there is no need to issue an additional credit note. However, internal VAT adjustments will be required.

- When an invoice is paid immediately, the settlement discount is automatically taken. The VAT is discounted on the invoice and no subsequent VAT adjustment is necessary.

For example, a 5% settlement discount is offered. You have invoice for £100 plus 20% VAT (£20). If the invoice is paid within the discount period, the VAT charged on this invoice will be discounted by £1 to £19 (5% of £20 = £1).

Ireland

In Ireland, VAT is always charged at the goods value regardless of any settlement discount.

Settlement discounts in Sage 200

It's pretty important to make sure that settlement discounts are entered correctly when transaction are processed in Sage 200. This makes sure that the VAT is calculated correctly and that you, or your customers, get the discounts due!

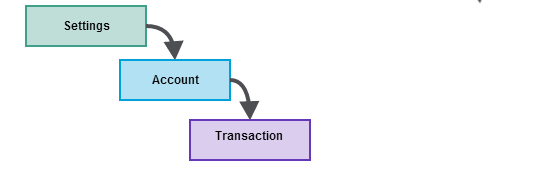

To help make sure that the correct discounts are always entered, you can store the discount settings on your customer and supplier accounts. Each time an order or invoice is entered, the discount details are automatically entered on the transaction.

When the payment is received from a customer, you can record the discount amount. This is then posted to the Discounts Allowed nominal account. When the payment is paid to a supplier, you can record the discount amount. This then posted to the Discounts taken nominal account. These are set in your default nominal accounts.

Setting up

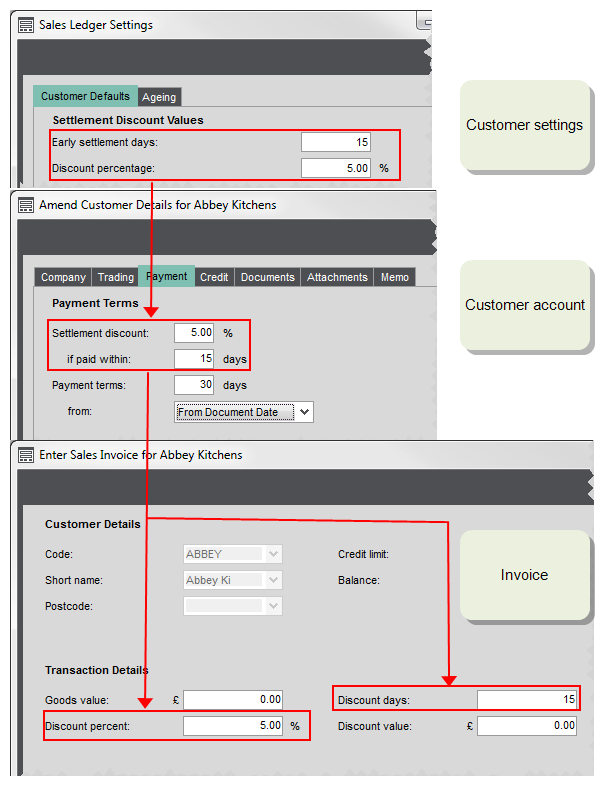

If you offer the same discounts to most customers, you can set this as a default in the customer settings. These defaults are automatically applied when you create new customer accounts.

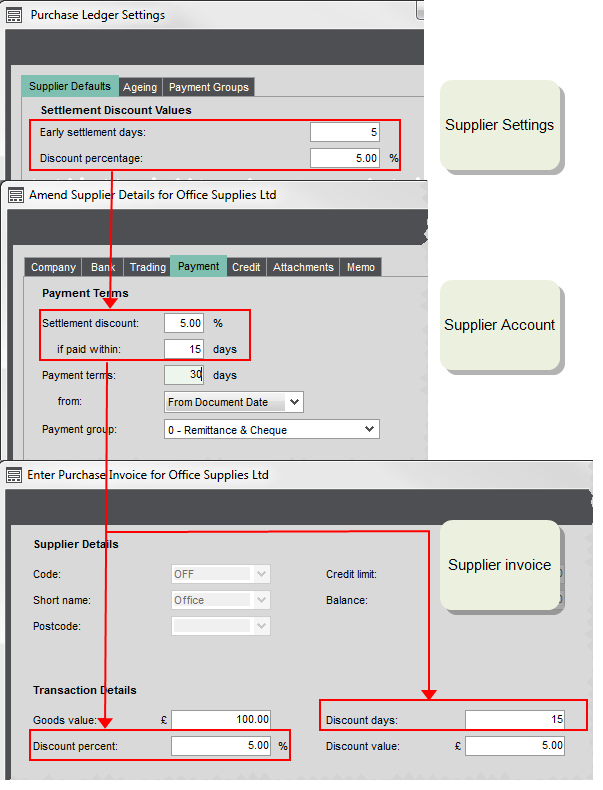

In the same way, if you receive the same discount from most of your suppliers, you can set this as a default in the supplier settings. These defaults are automatically applied when you create new supplier accounts.

-

Enter defaults in the customer settings:

Open: Settings > Customers and Suppliers > Customer Defaults and Settings | Customer Defaults.

- Enter the default Early settlement days.

- Enter the default Discount percentage

-

Enter discounts for each customer account if they are different to the default.

Open: Customer account | Payment tab.

- Enter the discount percentage in the Settlement discount box.

- Enter the number of days in the if paid within box.

In the same way, if most of your suppliers offer you the same discounts, set this as a default on your supplier settings.

-

Enter defaults in the supplier settings:

Open: Settings > Customers and Suppliers > Supplier Defaults and Settings | Supplier Defaults.

- Enter the default Early settlement days.

- Enter the default Discount percentage

-

Enter discounts for each supplier account if they are different to the default.

Open: Supplier account | Payment tab.

- Enter the discount percentage in the Settlement discount box.

- Enter the number of days in the if paid within box.

What do you want to do?

- See how to record settlement discounts on sales transactions

- See how to record settlement discounts on purchase transactions

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.

Other useful information

Create or amend customer accounts